Insurance contact center software

Provide a better experience for insurance customers across phone calls, live chat messages, social media, and more with Dialpad's Ai-powered customer engagement platform. Book a demo to see how its state-of-the-art Ai (built on a speech recognition engine that's analyzed over 50 billion hours of voice and message data) works!

Get up and running in no time

Easily migrate to the cloud

Reduce IT overhead with a modern contact center platform that takes minutes to set up. Add users, assign numbers, and set routing rules in just a few clicks.

Take calls from anywhere

Need to step away from your desk? Make outbound calls from your personal cell phone? Dialpad lets you flip calls seamlessly between devices without interrupting the conversation.

Keep your existing number

If you already have a main phone line, you can bring it with you when you make the switch to Dialpad. We'll help you port over your existing phone numbers.

A better customer experience, powered by Dialpad Ai

Maintain compliance with call recordings

Work in health insurance? Stay compliant while keeping a record of customer conversations and maintaining call center performance. Dialpad lets you set up automated call recordings and can pause recordings when it detects sensitive information being discussed for greater contact center security.

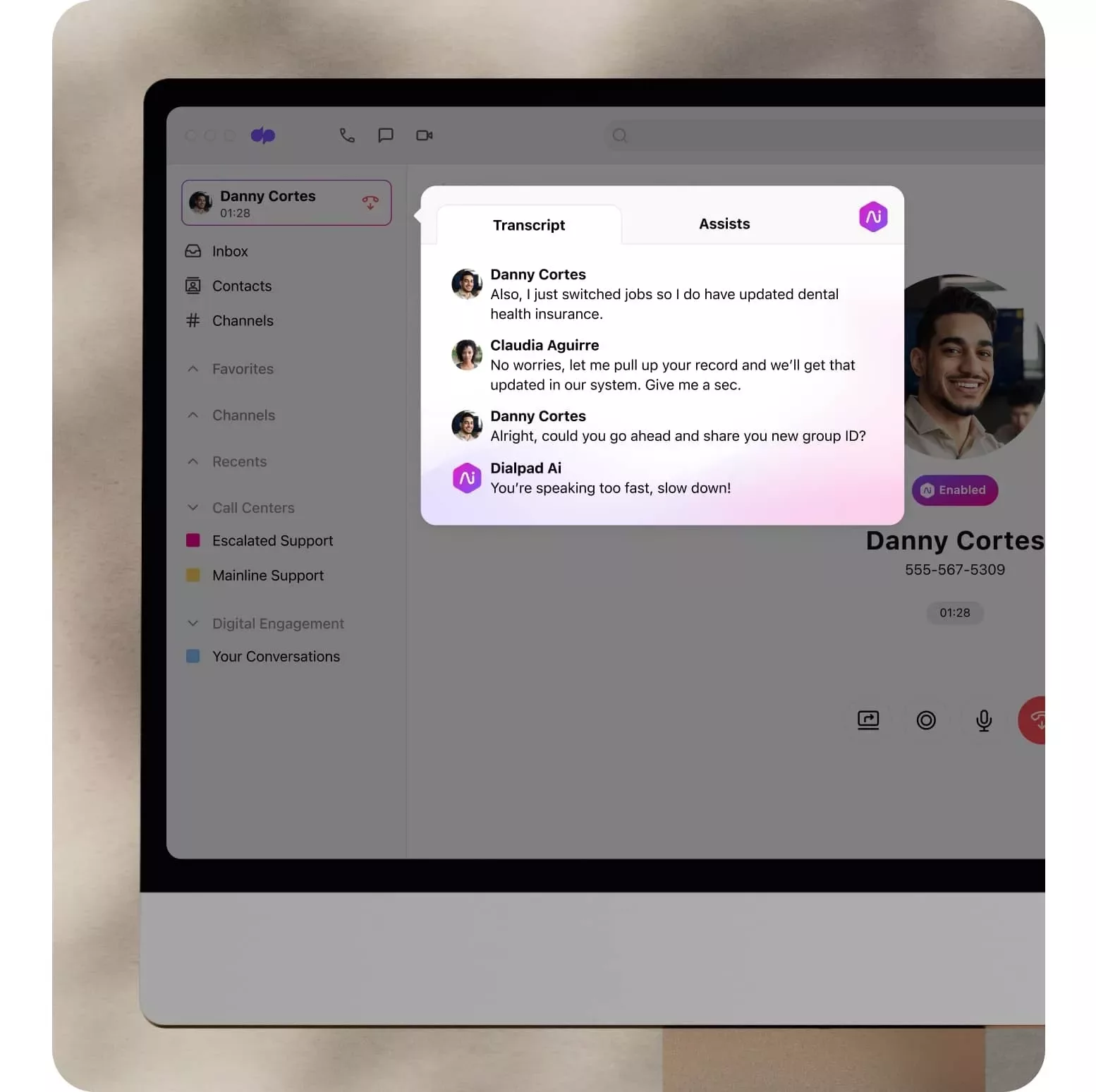

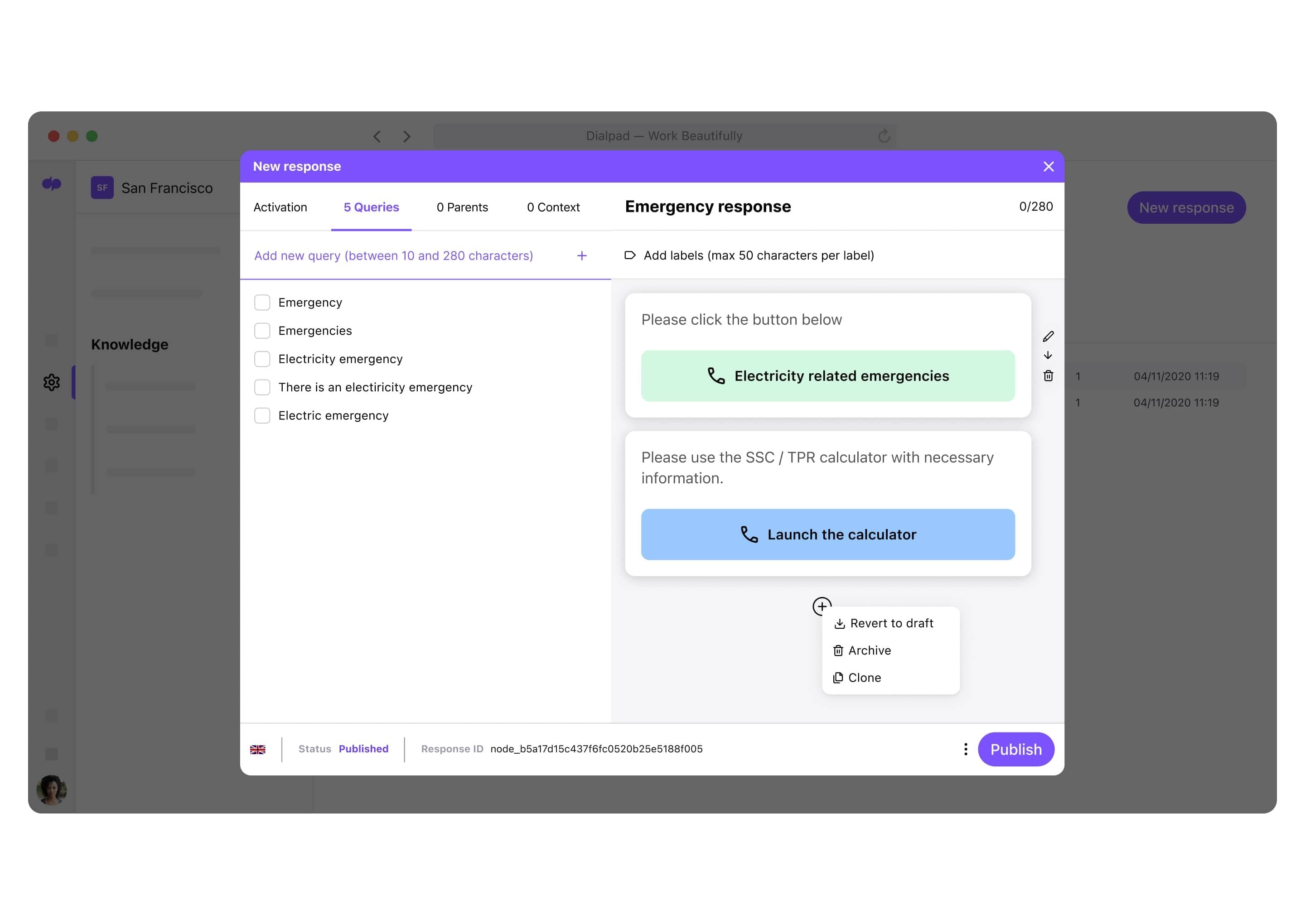

Real-time agent assists

Supervisors can create Real-Time Assist cards that automatically pop up on customer care and sales agents’ screens with helpful information when it detects certain keywords or topics being discussed. It’s like automated coaching—on a massive scale. (Learn more about Ai for insurance.)

A truly omnichannel experience

From phone calls to live chat messages to social media platforms like WhatsApp and Apple Business Chat, your call center representatives can handle any touchpoint and channel with Dialpad Ai Contact Center.

Running an insurance contact center?

See how different types of insurance providers are using Dialpad Support. Book a demo with our team, or take a self-guided interactive tour of the app on your own first!

Handle every inbound call and message with ease

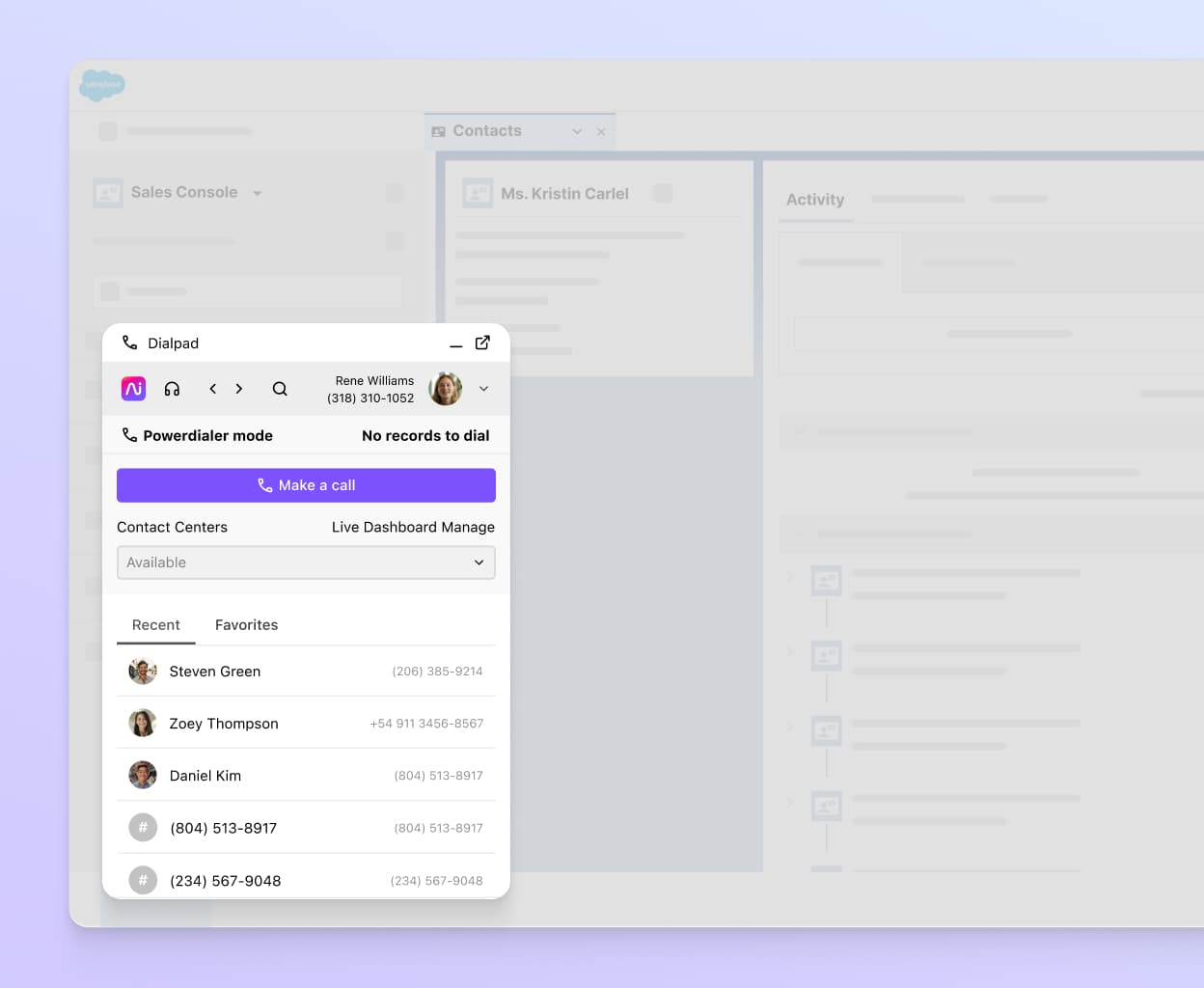

A wide range of integrations

Dialpad integrates with a range of CRMs, cold calling software, customer retention tools software, and more. For example, it embeds a CTI dialer right inside your CRM (like Salesforce or Zoho CRM, so agents can make phone calls without switching windows), matches callers to customer information, and even automatically logs activities and calls.

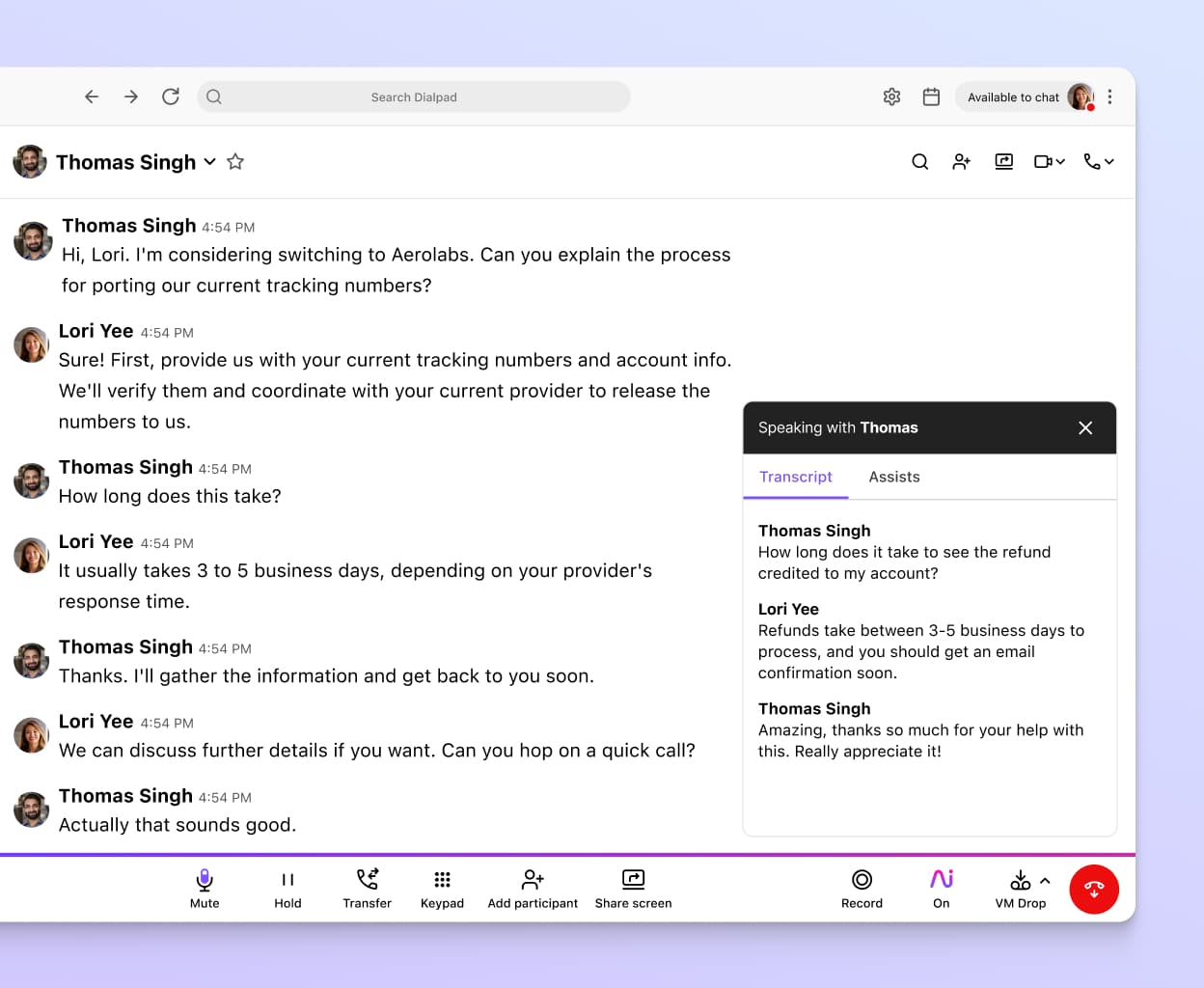

Live transcriptions

Dialpad Ai can transcribe phone calls—in real time. Not only that, it can do live sentiment analysis too. This way, supervisors can oversee multiple active calls more easily and quickly scan the real-time transcript for context before deciding whether to jump in to help the call center representative.

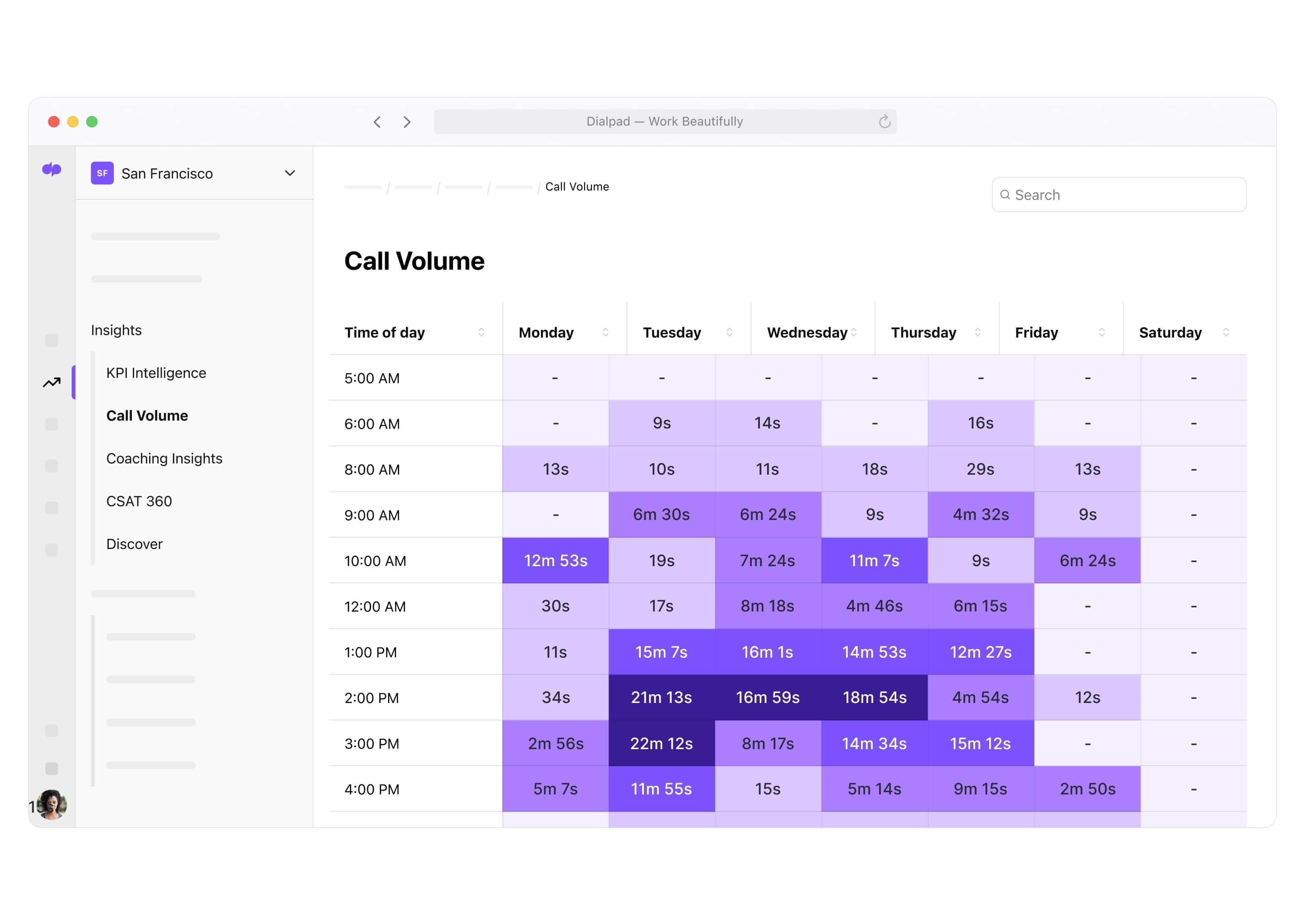

Analytics and dashboards at your fingertips

Help supervisors keep a close eye on call center quality assurance and agent performance. From customer satisfaction scores to how often “enrollment” comes up in conversations, you’ll find a wide variety of built-in analytics in Dialpad Support.

Let customers self-service

Want to reduce the burden on your customer care team? You can also build chatbot or conversational Ai flows easily with the no-code drag-and-drop builder.

HD call quality, worldwide

Fun fact: Dialpad’s global voice network and unique dual cloud architecture are designed to give contact centers excellent call quality, no matter where you are.

Further reading:

Advanced

$115

user/month

Elevate your support with real-time coaching and comprehensive analytics for superior customer interactions.

Everything in Essentials, plus:

Guide agents with live coach cards

Trigger and log specified moments in CRM

Expand reach with additional channels

Premium

$150

user/month

Drive excellence with Ai-powered quality management tools to improve and maintain top tier customer service.

Everything in Advanced, plus:

Automate quality management

Measure CSAT on all calls

Gain actionable insights with advanced analytics

Forecast and shift plan with workforce management, available as an add-on